The era of 'Functionwashing'

+ more celebrity brands, another prebiotic drink, and more...

Hello hello!

Did you know we are just two weeks away from the Super Bowl of CPG, Expo West 2026!

And boy do we have a lot planned for you 🫵

We are partnering with The Angel Group (Hall A #874) recording live, on the floor interviews for our podcast The Curious Consumer!

On top of that, we are hosting our 2nd Annual Bubba Gump Shrimp event on March 5th! This is a wonderful event exclusive for CPG brands to, as we called its, Network & Nom. If you work for a brand or retailer, please RSVP here!

If you’re currently running an ambassador program, you already know how it goes:

At first, things are going well. And then you’re ready to scale. But for the first time, you hit a wall—recruitment gets messy, and then there’s a cascade of subsequent problems:

→ Activation stalls…

→ tiers get fuzzy…

→ ROI gets debated…

→ …and suddenly, spreadsheets take over.

Scaling isn’t about more creators. It’s about more structure.

It’s time for an upgrade—and an upgrade that only Endlss can provide. Endlss is the operating system behind serious ambassador programs.

News From the Week

Last week, we saw some (seemingly benign) news: a brand launched a ready-to-drink protein shake “+ Creatine.” Creatine is certainly having its moment, and as a supplement associated with fitness and muscle growth, it only makes sense to pair it with a protein product. Why not throw another benefit into a bev, right?

But upon further investigation, I (Jenna) discovered that the brand only included “1000 mg of creatine” (stated in the press release)—which is a strategically deceptive way of saying 1g of creatine, or only 1/5 to 1/3 of the widely recognized effective daily dose.

This is by no means a takedown of that brand. I’m actually a fan, and will continue to buy its products and presume the humans behind it are wholly well-meaning. But this brand did something that bothered me. Something that I’ve seen countless times now, from countless other CPG offenders. And—on an unusually productive, frustration-fueled walk—I finally devised the language to call it out for what it is: Functionwashing.

In 2026, consumers are inundated with nonstop noise about the countless things we should be doing for our health. It pervades social media, pop culture, conversations with peers, even subway ads… everywhere we look, something or someone is telling us that we need to do more to be healthy.

According to The New Consumer’s 2026 Consumer Trend Report, 43% of Gen Z and millennials consider themselves in “optimization mode,” and two-thirds of Americans are taking supplements, vitamins, or wellness compounds.

And—when faced with the never-achievable task of constant improvement—it’s only human to seek a shortcut. Plagued with full schedules and clashing priorities, we look for quick-fix solutions to address our laundry list of societally-imposed health goals. Enter: “functional” CPGs—a three-in-one fix of satiation or hydration, sensory stimulation (taste), and the shiny promise of function.

This legitimate desire for functionality has created a perfect breeding ground for exploitation. When consumers are willing to pay premium prices for products that promise health benefits—and when they trust that brands wouldn’t make claims they can’t back up—underdosing becomes wildly profitable. Brands can upcharge for a “gut-health soda” or a “stress-relief adaptogen drink,” knowing most consumers won’t verify the dosages against clinical research.

This is different from healthwashing, which is vague “natural” or “clean” claims that disguise a nutritional reality. Functionwashing is blurrier than healthwashing: A skeptical consumer might question “clean,” but wouldn’t double-take at “contains creatine”—and they’re right not to. It does contain creatine. The deception isn’t the ingredient’s presence; it’s the insufficient dose.

Here’s why it works: FDA structure/function claims don’t require pre-approval. Brands just need that tiny disclaimer nobody reads and “substantiation” the claim isn’t misleading. Perfect loophole.

This pattern shows up across categories—brands adding just enough of a functional ingredient to claim the benefit, but not enough to deliver it.

Take collagen claims. Most RTD collagen products contain 1-3g per serving. Clinical research uses 2.5-15g daily depending on the benefit—studies on skin and beauty typically use 2.5-10g, while joint health research often requires 10-15g.

Separately, there’s the collagen protein problem. Many brands market collagen products as “high-protein” options, positioning them alongside—or as alternatives to—complete protein sources like whey or pea protein.

The issue: Collagen is an incomplete protein because it lacks tryptophan, one of the nine essential amino acids your body can’t produce on its own. Yet you’ll see collagen drinks marketed with labels like “20g protein!” next to their beauty claims. Technically true—collagen is a protein—but misleading in context.

The result: Consumers think they’re hitting their protein goals with a $6 collagen water… when they’re actually getting an incomplete amino acid profile that won’t support muscle recovery or synthesis the way complete proteins do.

Stress-relieving claims: This is where it gets even murkier. Many products claim “stress-relieving” benefits thanks to ingredients like ashwagandha or L-theanine. Research recommends 300-600mg daily of ashwagandha for stress reduction and 200-400mg of L-theanine for cognitive effects and stress reduction. But most “adaptogenic” products don’t list a single number—just “ashwagandha root extract” or “L-theanine” listed somewhere in the ingredient panel.

Prebiotic- and probiotic-touting products are also major offenders. Just look at Poppi: Poppi basically became the poster child for functionwashing when it settled a class-action lawsuit for $8.9 million in March 2025.

Poppi came out of the gates calling itself a prebiotic soda… but it only contained 2g of agave inulin per can. Science says you need 5-7.5g of prebiotics daily for gut benefits. If you’re doing the quick maths here, you’d need 4+ Poppis daily to hit that threshold—at which point the sugar negates any benefit.

So the brand paid (a lot) to settle. But that price tag looked like pennies compared to PepsiCo’s concurrent purchase of the company for $1.95 billion. Doesn’t seem like PepsiCo cared all that much that the brand was deceptive—people were still buying it.

The most frustrating part of all of this? Functionwashing—like so many marketing strategies built on deception—just might be… a really good business strategy.

This isn’t accidental. Industry insiders openly acknowledge that many functional foods “include active ingredients in amounts too low to produce effects.” Brands can charge 2-3x more for subtherapeutic doses because most people won’t calculate effective dosing or dig through clinical research—and even if they wanted to, the dosage information often isn’t disclosed in the first place.

So what do you, a Curious Consumer (😉), do to stop functionwashing?

Watch for disclosure avoidance: If a brand proudly lists “creatine” but won’t tell you how much, that’s a red flag!!!

Do the math: How many servings would you need to hit effective doses? If it’s 4+ daily, it’s not functional—it’s marketing.

Demand transparency: Support brands that voluntarily disclose functional ingredient amounts. If they’re using effective doses, they should want to tell you.

The “food as medicine” impulse is real, and the science behind these ingredients is legitimate. The creatine boom, collagen explosion, adaptogen trend… all are built on real research. But, critically, that research used effective doses. When brands take that science, add 20% of a working dose (or hide the dose entirely), and charge premium prices? That’s not wellness. That’s exploitation.

To our brand and marketing friends: In 2026, when we’re already overwhelmed with health advice from every direction, what we really need is honesty. I wish I didn’t need to think up a term to describe such a rampant, deceptive practice. I wish we could all trust the claims your products are making, without burdening the exhausted shopper with conducting their own research. I wish we could be a little more okay with some food and beverage products just being… food and beverage products. Not quick fixes, life-changing solutions, the magic pill for everlasting youth—just really tasty, quality products that bring us a little more joy.

As Nate said: We’re not asking for perfection—just a little more transparency.

CPG & Consumer Goods

A fiber rich sparkling water, you say? Maison Perrier—an extension brand of the famous Nestle-owned Perrier sparkling water—just launched its first-ever sweetened, prebiotic sparkling water, French Kiss. Each can contains 6g of fiber and <1g of sugar, because it wouldn’t be a beverage in 2026 if it didn’t have a prebiotics claim.

At a suggested MSRP of $8.49 for a 6-can pack, this is a more approachably priced prebiotic bev than the Modern Soda darlings, OLIPOP and Poppi.

It’s interesting to see a brand and company that’s largely embraced simplicity and tradition sneak its way into the cool kids table. The OLIPOP/Poppi effect on the beverage aisle cannot be overemphasized.

The at-home barista trend gets its protein match. Nurri, a protein drink brand known for its canned ultra-filtered protein milks, is launching protein creamers exclusively at Walmart. The new line includes three flavors: Sweet Cream, Salted Caramel, and Chocolate.

This launch comes just one week after Lactaid entered the coffee creamer market with its own dairy-based line, signaling a major convergence of multiple trends: dairy is making a strong comeback, consumers are actively seeking protein in everything, and consumers are becoming increasingly interested in making cafe-quality coffee drinks at home—with demand for flavors and add-ins at an all-time high.

A celebrity brand with legs. Supermodel Ashley Graham has launched Lucci, a new Lambrusco sparkling red wine priced at $19.99. It’s produced in Emilia-Romagna with award-winning generational winemakers and affordably priced at $19.99.

Last week I got to meet the wonderful Ashley Graham at the launch event for Lucci here in NYC. It’s a very tasty and well-branded Lambrusco that I would love to have as a staple in my wine collection. You could tell how much passion and love Ashley has for this brand of hers! Check out my full thoughts in last week’s Weekly Pickups! - Nate

Ingestible beauty. Purely Elizabeth launched its first ever, limited-edition, beauty-inspired granola, made with collagen peptides and biotin—timed to launch during New York Fashion Week. The Purely Glow Salted Vanilla Pistachio Granola is available on the brand’s site, TikTok Shop, and Cha Cha Matcha locations.

While this might be the first granola we’ve seen that is making beauty claims, it’s certainly not the first food or beverage product to do so. In the beverage space, Pretty Tasty is a collagen-infused iced tea with 10g bovine collagen. In the food space, Singing Pastures has collagen-infused meat sticks. Just to name a few.

Though we can’t yet confirm, this may be another example of functionwashing. The brand doesn’t disclose the amount of collagen peptides or biotin in the product, which unfortunately can only lead us to assume that it isn’t enough of either to be efficacious. On the bright side, this SKU is priced the same as its SKUs that don’t claim a function—so if you like pistachio and granola, it’s certainly still worth trying!

There’s a candy renaissance going on. Jake Shane, the influencer and comedian with over 5 million followers, has been named chief creative officer at German candy company Katjes, aiming to expand its $1 billion gummy business in the U.S. He’ll steer brand messaging and marketing strategies for the brand, because candy should be fun!

Jake Shane (aka @passthatpuss on IG) Katjes is a family-owned candy business that’s been around since 1910! They were a very early adopter to the dye free craze....removing artificial food coloring in 1988. And by 2016, it was an fully plant-based brand (rare for a gummy company, which usually contain animal-based gelatin). We praise brands doing this today, but Katjes has been at it for decades!

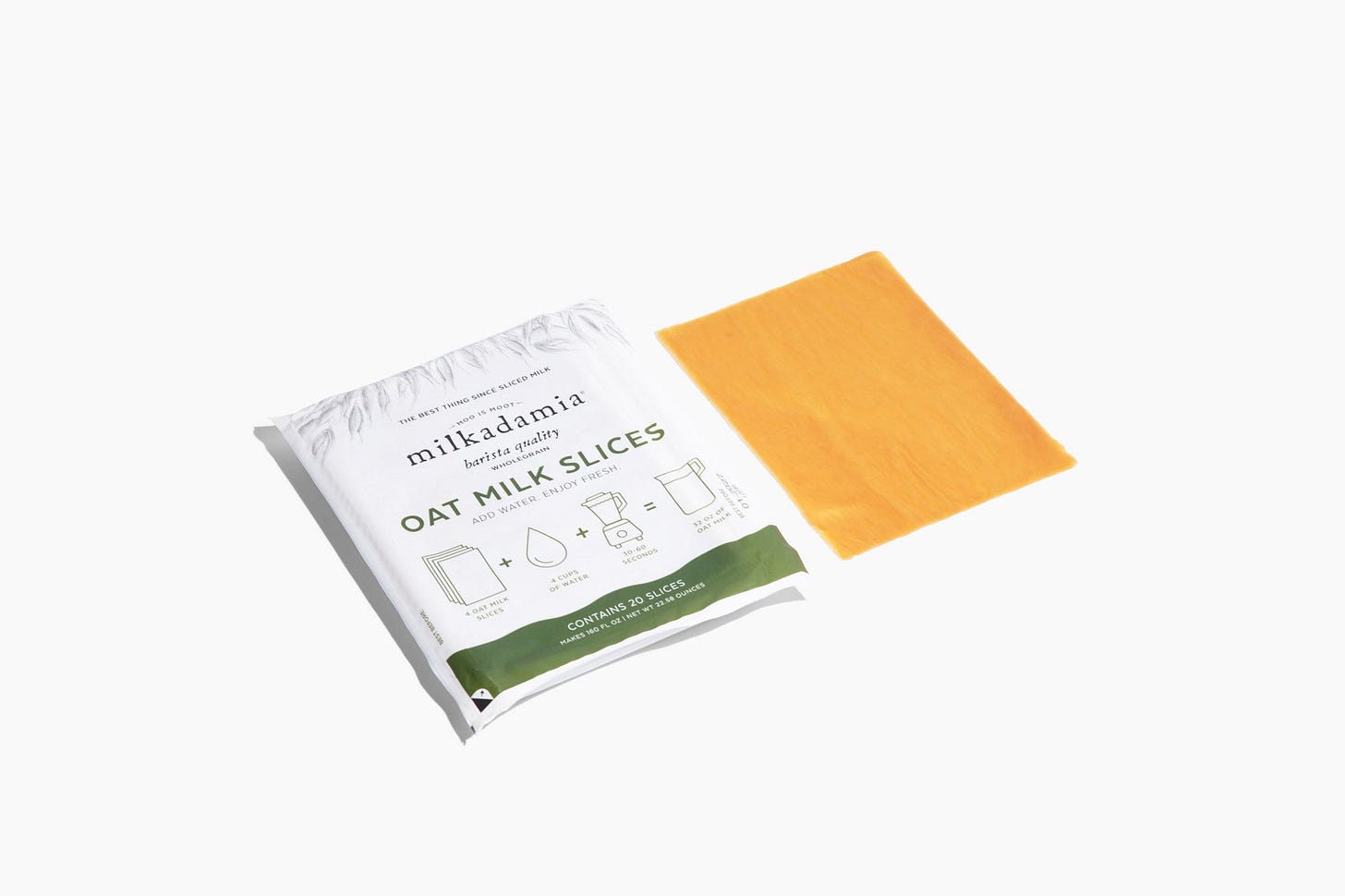

Finally, some (genuinely) sustainable innovation. milkadamia’s shelf-stable Oat Milk Slices are now available at Target after a November 2025 DTC launch. Each “slice”—a flat, paper-like sheet of oat milk concentrate—uses 84% less packaging, and has an 18-month shelf life. Once blended with water, one slice makes 32oz of oat milk and retails for $4.79—about 20-30% cheaper than traditional oat milk.

Very curious to see how this is received. While this is a sustainable solution and only takes 60 seconds to prepare (by blending with water), it removes the perceived convenience of a ready-to-use oat milk. It’s also just challenging to introduce a product that requires education for use within a category that typically requires little-to-no education, and the $4.79 price tag—while cheaper per ounce once blended with water—appears hard to justify when you’re only judging the flat, 4.5oz packet.

Another celeb beauty brand. Cardi B is stepping into the beauty arena with her new hair brand, Grow-Good Beauty, launching this spring in collaboration with Revolve Group. This marks her first owned beauty line, coinciding with her upcoming tour, “Little Miss Drama.”

This is not Cardi’s first go at a consumer brand: in 2021, she launched Whipshots, a first-of-its-kind, vodka-infused whipped cream in partnership with Starco Brands. Acting as the brand’s creative director and equity partner, she turned the product into a viral phenomenon that surpassed five million cans sold within its first few years.

The tricky thing about third-party… Estée Lauder is taking Walmart to court, alleging trademark infringement over counterfeit products sold on its third-party marketplace, including items under the La Mer, La Labo, and Tom Ford brands. The cosmetics giant seeks a jury trial and demands that Walmart cease sales of the disputed products while disclosing their suppliers.

The important thing to note here is that Walmart itself isn’t the seller these products—it’s just the third-party marketplace where these products are sold, similar to how Amazon operates. But on Walmart.com, it appears as though Walmart is the seller of the accused products—a practice that could be deceptive to shoppers. Still, Walmart should be responsible for vetting its third-party brands.

Skincare meets sex care. Vira is a new Ayurvedic brand combining body care with sexual wellness, with products like Sex Serum and Play Oil, aiming to overcome retail challenges facing the sexual wellness market. Each formula is made with EU-certified clean ingredients and “designed to elevate everyday intimacy.”

The body care market is absolute booming, with many brands like Tower 28, Jones Road Beauty, and California Naturals expanding from face and hair lines into full-body care products. Overall, body care products are thriving at retail, making them an ideal gateway for sexual wellness brands to enter prestige beauty spaces.

Vira is capitalizing on this momentum while addressing the struggles sexual wellness brands have faced in prestige retail. While Maude became the first sexual wellness brand stocked in Sephora’s physical stores in 2023, few others have followed. Vira is part of a broader wave of brands destigmatizing taboo topics—similar to Norms (hemorrhoid care), Julie (after-sex care), and Asset (tushy health)—making previously uncomfortable conversations mainstream.

eCommerce

Is this the future of retail media? Target is partnering with OpenAI to test contextual advertising in ChatGPT with its Roundel retail media network, allowing ads to appear during shopping conversations based on user prompts. As traffic from ChatGPT to Target grows 40% monthly, this pilot aims to “enhance personalized shopping experiences without compromising user trust.”

Funding news

It’s time to call in a couples therapist… Kraft Heinz is pausing its plans to split into two companies, citing that many of its challenges are “fixable.” Instead, the company will invest $600 million in marketing and product development as it grapples with declining sales and a net income drop of 69.5% in Q4’25. Some background:

Steve Cahillane joined as CEO in December 2025, bringing serious CPG pedigree. He led Kellogg’s 2023 split into Kellanova and WK Kellogg, then oversaw Kellanova’s $36B sale to Mars. If anyone knows whether a company should split, it’s him—and he’s pumping the brakes.

The company determined that its core business is currently too fragile to stand alone. So they’re redirecting funds to focus on marketing, R&D, and strategic price adjustments to win back consumers who’ve been fleeing to private label brands.

Like everyone in CPG, Kraft Heinz is feeling the squeeze from price-conscious consumers moving to store brands. Private label sales jumped to $282.8 billion in 2025, and Kraft Heinz has been hemorrhaging market share for years.

Kraft Heinz has been seeing eroding market share across its brands over the past decade. Flagship products like Kraft Mac & Cheese have steadily lost ground over the past 3 years to private label brands and health-conscious competitors like Goodles, which now controls 6% of the boxed mac and cheese market.

More broadly, the era of splitting companies for valuation gains seems to be cooling. Meanwhile, competitors like PepsiCo and General Mills have seen success with price cuts—a strategy Kraft Heinz may need to embrace.

Betting on the BFY boom. Refresco, the global beverage bottling giant, is acquiring SunOpta, a natural food product producer, for approximately $1.1 billion.

If you don’t know, Refresco is a silent giant behind the scenes—it’s the world’s largest independent bottler! Refresco handles manufacturing, packaging, and supply chain for global brands and private-label store products, specializing in juices, carbonated soft drinks, and mineral waters.

Meanwhile, SunOpta is a US-based manufacturer focused on plant-based products and organic foods. They’re major players in oat, almond, and soy milk production, as well as fruit-based snacks, smoothie bowls, and organic broths. They have their own brands you may have seen on store shelves: Sown, Dream, and West Life.

Proof people want a sweet treat. A real one. Tastee Apple Inc, a confectionery and speciality manufacturer, acquired Art of Sucre LLC, known for its viral ready to eat cotton-candy and drink glitter bombs.

Tastee Apple is a family owned and operated confectionery brand that has been on the market since 1974 best known for their candy apples. The brand has sold over 250,000,000 candy apples and are available online and across major retailers like Walmart, HEB, BJ’s wholesale, and Giant stores.

Art of Sucre, on the other hand, is a vibrant and modern brand that’s collaborated with brands like Kendall Jenner’s 818 tequila. Art of Sucre initially started as an events wholesale business, then pivoted to focus on online sales in 2020. With this acquisition, Art of Sucre can now further leverage Tastee Apple’s established distribution arm to expand their reach into retail channels nationwide.

It’s refreshing to see this acquisition happen while everyone else is busy demonizing sugar and pushing all these weird alternatives. Not everything needs to be “guilt-free” or made with monk fruit. Sometimes a real sweet treat is exactly what we want (and need).

Spare your eyes, listen to us yap.

Check out our recent episode of The Curious Consumer! We talked about what the 2026 Super Bowl ads told us about consumer trends, Once upon a Farm IPO, and more!

If you haven’t yet, please subscribe, like, leave a comment, and share it! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.

Great piece on functionwashing! One aspect you didn't mention in addition to inadequate dose, is stability. Many of these "functional" compounds don't survive the physical and thermal processing required for CPG products, or the shelf conditions thereafter. You might ask a functional brand how much of the original dose is still present (hasn't broken down) and active at the stated shelf life of the product. If you seriously believe in a supplement, and want its supposed benefits, research a reputable supplement manufacturer and take the effective dose in a stable supplement form. And let food be food again!!

function-washing it is! in my "optimistic" opinion, this may be something that marketers and brands will have to come more clean about not only because of regulations etc. but also the fact that apps like Yuka or more so AI is getting people to read into the ingredients and become more educated when it comes to differentiating label vs truth. as you featured before M&S has been on the "no bs ingredient list packaging" for a while now and I think they are on point with timing. LOVE it for katjes & jake shane. match made in heaven. thank you for the newsletter!!!