Building the perfect celebrity brand

+ e.l.f's first fragrance, the new non-UPF Certification, Purell gets acquired, and more

Hello hello!

This week, we’re diving into the makings of a great celebrity CPG brand. We spoke to three co-founders of celebrities, all of whom shared how celeb buy-in fully altered their credibility and opportunities to scale. But for non-talent-led brands: how do you build this kind of legitimacy?

One of the most critical pieces just might be… creator content.

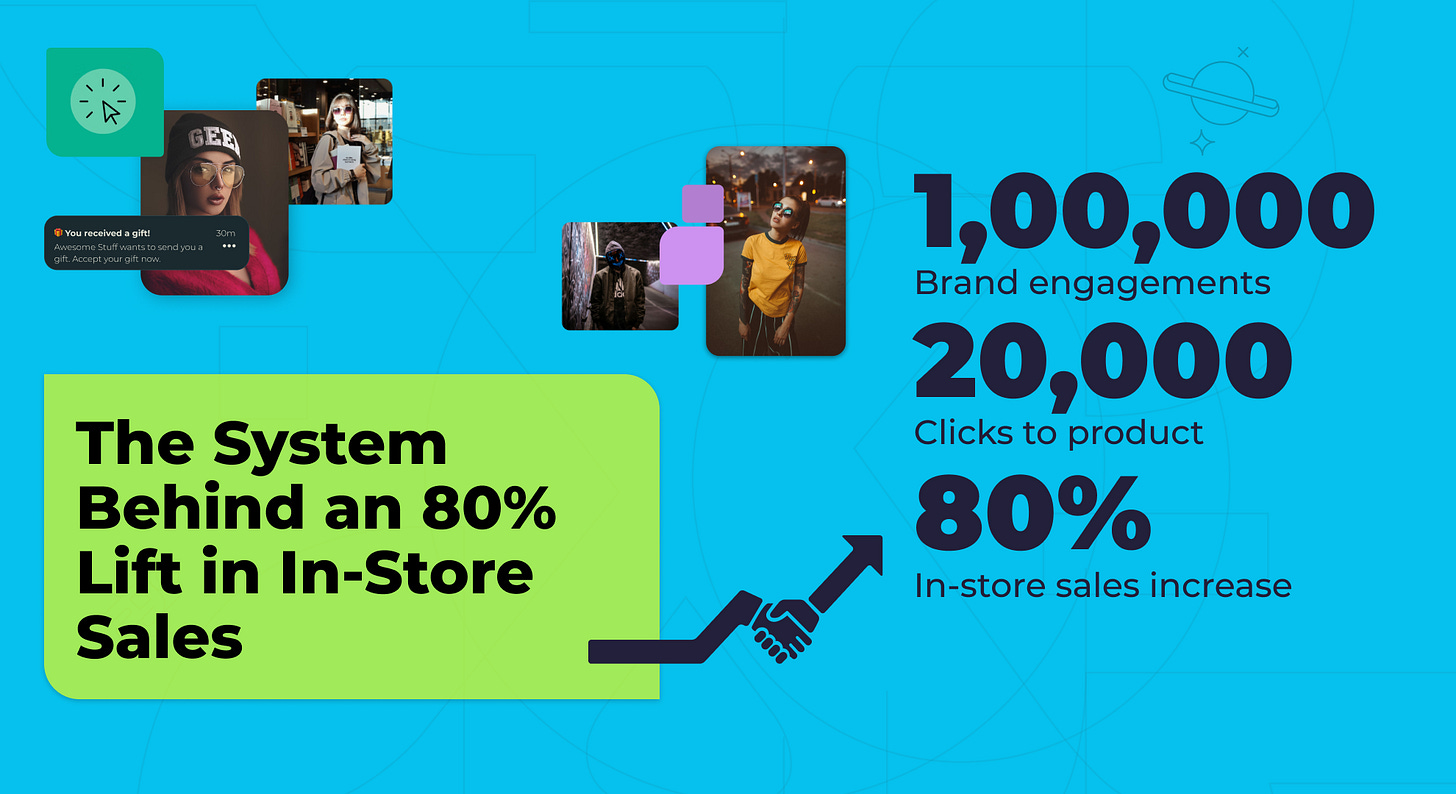

To support brand awareness and retail momentum, a fast-growing beverage brand needed authentic creator content, delivered efficiently and without heavy internal lift. They needed to 1) identify creators already aligned with their brand and audience, and 2) activate them quickly, without manual work or scattered tools.

Using Endlss, alongside The Artists Agency, the brand launched a creator program built for precision and scale. The result was a repeatable system:

High-fit creators discovered and activated fast

AI Copilot–personalized outreach that increased response rates

Seamless gifting that removed friction from activation

Authentic UGC flowing consistently

Content reused across social, paid, and retail

The impact?

20,000 product page clicks in one month

6.7% creator response rate

Over 1 million brand engagements

An 80% increase in in-store sales!!!

News From the Week

Two weeks ago: Guillermo Rodriguez launched Guillermo’s salsa after 20+ years as the beloved “sidekick” of Jimmy Kimmel Live.

Last week: Ben Stiller was spotted at a Whole Foods in Jersey City, personally hawking his better-for-you soda company, Stiller’s Soda.

A few days ago: BERO—Tom Holland’s non-alcoholic beer brand—secured investment from BetterCo Holdings, pushing past a $100M valuation.

If it feels like there’s celeb CPG brand news every single week, that’s because… there is. While celeb-founded brands having been playing in CPG for a while now, there’s something underlying these particular stories—a stronger sense of legitimacy, diminished cynicism, a product-over-person focus.

We’re entering a new era of celeb co-founded brands. Not famous faces slapped onto white-label products, but brands built from day one by celebrities and seasoned CPG operators:

Guillermo teamed up with co-founder Chris Kirby, founder and CEO of Ithaca Hummus. Dips are Chris’s bread-and-butter—Ithaca actually had its own salsa line in 2023, which has since been discontinued.

Alex Doman, former CEO and Co-Founder of AVEC (a non-alc beverage recently acquired by Proxies), is bringing his canned, better-for-you bev experience to Stiller’s.

And, when Tom Holland’s sobriety journey brewed a business idea, he co-founded BERO with John Herman, former Chief Commercial Officer and President at Nutrabolt (owner of energy drink C4 Energy).

We reached out to each of these CPG operator co-founders to learn more about how they’re building sticky brands with talent.

First, a distinction that matters more than ever: As Chris (Guillermo’s) put it: “An ambassador relationship is transactional. A co-founder relationship is personal and permanent.”

Even when a celebrity holds the title co-founder, that level of involvement isn’t guaranteed. As Alex (Stiller’s) shared: “Ben and I are true co-founders. Most celebrity businesses are either orchestrated by agents or the celebrity is brought on later as an ambassador.”

These brands weren’t match-made by an agency to generate clout—they were all ideated and formulated by the celebrity directly—and you can feel the difference.

Because all three of these co-founders had led non-celeb brands, we couldn’t help but wonder how the experiences compared. Alex (Stiller’s) was blunt:

“At AVEC, we hit all the goals that were asked of us by investors and still could not raise. The financing market had turned, and what had been great KPIs were suddenly un-investable. I did not want to put my family through that again. When I met Ben, it was immediately obvious that we would start with unfair advantages that, if managed correctly, could build deep moats around Stiller’s.”

John (BERO) saw similar momentum:

“BERO has been afforded the luxury of momentum that a brand in its stage without Tom would not be afforded. When we launched C4 Energy, it took 5+ years of brand momentum to get to the table for distribution. We had that opportunity pre-launch with BERO.”

Chris (Guillermo’s) identified what that advantage looks like in practice: “Retailers want to excite consumers because excitement drives growth. A celebrity brand gives category managers a chance to inject energy and relevance.”

Massive advantages, yes, but they still come with real constraints:

Celebrity speed is expensive—and risky. A non-celebrity brand can soft-launch regionally, test and iterate, figure out unit economics before scaling. But a celeb brand demands scale from day one. You can’t have Tom Holland doing press tours for a brand that’s only in 50 doors. The optics are all wrong.

As Alex (Stiller’s) explained: “Every category has certain laws of physics, such as landed gross margin and supply chain constraints, that dictate the speed you can responsibly move.”

This is the trap: Celebrity creates momentum you didn’t earn. Momentum without foundation is a recipe for failure.

And finding the right partners gets harder, not easier. As John told us: “The biggest challenge is working through partners interested in BERO vs. purely leveraging BERO for access to Tom. If the grounding of a commercial relationship is purely that of a talent deliverables list, then more often than not that isn’t the right partner for us.”

After talking to these three operators, the pattern was clear: the celebrity brands that work are the ones where the celebrity is a co-founder in the most literal, unglamorous sense. They show up to retailer meetings. They respect operational constraints. They’re in it for the long haul.

For the non-celeb cofounders, this model offers a second shot at building in categories where they’ve already learned expensive lessons: Alex gets to avoid AVEC’s fundraising nightmare. John gets C4-level distribution momentum from day one. Chris gets to relaunch in salsa with built-in retail excitement.

When it works, it’s genuinely symbiotic. Celebrities get credible operators who won’t let them fail publicly. Operators get unfair advantages that actually move business metrics. And consumers get something rare: brands sparked by creative vision, built with operational rigor—and, occasionally, a new grocery staple worth believing in.

CPG & Consumer Goods

Spindrift sets a new standard. Spindrift became the first beverage company to receive non-UPF (ultra-processed food) certification this week, joining pilot brands like Simple Mills and Amy’s Kitchen. The verification validates Spindrift’s longtime approach of using real fruit juice with no added sweeteners.

We spoke with Jon Silverman, SVP of Innovation and Business Development at Spindrift, who shared why this was so important for the brand:

“We make what we feel is a very unique product, and we do it at scale... it’s not that easy to communicate the uniqueness of Spindrift very succinctly. ‘Not from concentrate juice’—may not resonate with some consumers. Non-UPF validates the sentiment that Spindrift does something that is pretty hard to do.”

The challenge of a brand-new certification? Balancing meaningful standards with adoption. “I’m of two minds—I want there to be a high bar,” Jon told us. “But if Spindrift is the only bevearge brand that ever gets verified, you never get to critical mass and it’s not a movement.”

The protein ice cream wars see no signs of melting.

Legacy ice cream brand Blue Bell launched its own version of a protein ice cream, PRO. It contains 33-35g of protein, 310-340 calories, and 0g of added sugar per pint.

Swoop is a new high protein ice cream brand that just launched in Target nationwide featuring 30g of protein and 380 calories per pint.

Both are joining a litany of startups vying for the high-protein, frozen sweet treat market like Smearcase, Protein Pints, Sweet Gains, and other legacy brands like Yasso (which launched protein pints last Fall).

Two plant-based protein milks enter the chat:

Ripple Foods launched Ripple Organic Plant-Based Milk in Original and Vanilla flavors, offering 5g of plant protein per serving with allergen-free, minimal ingredients (a base of peas!). This follows a $17 million funding round led by in late 2025, led by Rich Products and Material Impact.

Meanwhile, Califia Farms an organic plant-based milk company, launched its first-ever Soymilk, featuring 8g of protein per serving and made with just three ingredients: organic soybeans, water, and sea salt.

The fragrance boom continues…

H&M and e.l.f. Beauty partnered to launch a limited-edition eau de parfum collection: H&M’s first beauty collaboration and e.l.f.’s own debut into the fragrance category.

It’s interesting that e.l.f. hasn’t entered the fragrance category yet, when they have touched almost every single other skincare and beauty space. With their mass market appeal (and especially mass market pricing) H&M as a early partner makes a lot of sense.

The Nue Co. is launching its “mood-boosting” fragrances at Ulta Beauty, including placement in their new shop-in-shop concept (see retail section).

Nue Co really fits well into this new world of wellness: It can sit in the fragrance aisle, but also the new wellness aisle as a “functional fragrance.” As retailers like Ulta and Target double down on wellness shop-in-shops, expect more brands to reframe their products through this lens, whether they’re launching in fragrance, personal care, food, or beverage.

Athena Club, a personal care brand best known for its shaving and body care products, is expanding into fragrance with a hair and body mist line in eight scents.

The brand is explicitly positioning this as a “fragrance wardrobe” line—even using that exact language in their marketing—tapping into the trend among younger consumers. Unlike previous generations who favored signature scents, Gen Z prefers a variety of fragrances that let them choose based on mood or vibe. The shift has fueled fragrance category growth, with Gen Z spending over $200 a year on colognes and perfume—around $40 more than the average consumer. We explored this trend in depth in our previous issue, Men want to smell good now.

Men will look better in 2026. Men's grooming brand Viking Revolution is launching in 900 Walmart stores, marking its first major brick-and-mortar expansion. The brand built its success on Amazon, and it’s apparently on track for $59M in revenue this year. The Walmart rollout includes bestsellers like beard oil, sea salt spray, and solid cologne at accessible price points.

Kodiak stirs up breakfast. The beloved protein-focused brand just launched Overnight Oats, tapping into the booming convenience food market.

Given how successful Oats Overnight has been, I’m shocked it’s taken them this long to launch a similar product! They doubled annual revenue from $100M in 2024 to $200M in 2025. And along with having over 250,000 DTC subscribers they’re also sold in stores nationwide. - Nate

Retail

Blurring the line between “beauty” and “wellness.” Ulta Beauty is piloting wellness shop-in-shops in four stores next week to test the concept before potentially expanding. This will double the wellness footprint in these locations, which was already greatly expanded earlier last year.

This pilot comes just after Target announced similar changes to their stores online and offline, emphasizing and growing their wellness portfolio.

Funding

What doesn’t Snoop Dogg do?! Rising Tide Ventures invested an undisclosed amount in Snoop Dogg’s Dr Bombay ice cream. The brand has raised ~$8M to date. Ruchi Desai, the founder of Rising Tide, is no stranger to celebrity brands—she co-founded EIGHT beer with NFL Hall of Famer Troy Aikman. So she should know what makes one successful.

Dr Bombay is crushing it. According to Venture Society Labs, it’s the #2 sherbet ice cream brand in the U.S., growing to more than 2x the size of the next competitor. Plus, they have a partnership with Live Nation to expand their ice cream to a new (captive) audience.

Hand sanitizer is Big Business. Clorox acquired GOJO Industries—makers of Purell—for $2.25 billion in cash, ending 80 years of private leadership by the Lippman-Kanfer family. Founded in 1946, GOJO grew from a local Ohio business into the global leader in skin health and hygiene solutions like Purell.

As our friend Jacob Tubis, Co-Founder of Byte’m Brownies, explained in a LinkedIn post, it’s fascinating when you put this into perspective relative to the Church & Dwight’s Touchland acquisition for ~$880 million. It seems that Clorox, more than anything, is buying GOJO for it’s vast B2B network—Purell generates 80% of revenue through B2B distributors backed by 20 million installed dispensers.

Chruch & Dwight, however, acquired Touchland for its cultural cachet and consumer-facing appeal—a brand that transformed hand sanitizer into a lifestyle product with sleek design and premium positioning. Touchland has quickly become the #2 player with only ~$130M in annual sales versus Purell’s ~$800M—it commands attention through brand aspiration rather than market dominance.

While it might not be as sexy or culturally relevant as Touchland, Purell has done something that few brands can do define a category. It’s so close to becoming “genericized” similar to how Band-Aid or Kleenex are used instead of bandage and tissue.

It’s getting hot in here. Dallas-based Highlander Partners acquired Tapatio, the #5 hot sauce brand in the U.S., from the Saavedra family. Founded in 1971, Tapatio plans to expand geographically, develop new products, and deepen retail and foodservice penetration. The Saavedra family retains a minority stake.

Other’s are also betting on heat. McCormick has been adding hot sauces to their portfolio over the past decade with Cholula in 2020 and Franks Red Hot from Reckitt Benckiser in 2017.

New-age sports drinks are having a moment. Coco5, the coconut water sports drink brand backed and owned by NBA stars Devin Booker and Charles Barkley, secured $10M in funding led by Loop Capital. The investment will fuel expansion, executive hiring, and production growth as the brand scales beyond 7,000 retail doors into wellness and healthcare channels.

BFY BFFs. Creations Foods, a snack food manufacturer platform with brands like keto-friendly HighKey Snacks and Moon Cheese, merged with Get Real Foods, known for their plant-based, and allergy-friendly cookies made with simple ingredients. The merger creates a vertically integrated CPG platform.

Creation Foods is a food manufacturer specializing in better-for-you, gluten-free, and allergen free snacks such as cookies, crackers, and cheese crisps. They produce both branded and private-label products. They acquired HighKey Snacks in 2024 and Moon Cheese in 2023.

We’re moving into a more health-conscious American snacking market. Whether or not these consumers actually understand what makes a product “better-for-you,” they’re going to be seeking “cleaner” and “simple ingredient” products.

“Clean” Tums gets scooped. Procter & Gamble acquired Wonderbelly, a “modern digestive medicine brand” founded in 2021. They make, let’s call it, yassified alternatives to Tums and GasX: a prettier cousin of the name-brand but with the same active ingredients—sans artificial dyes, sweeteners, or titanium dioxide (which is just a UV-blocking agent).

Wonderbelly is part of a growing wave of brands reimagining the OTC aisle with softer branding, friendlier language, and a cleaner-label narrative. We’ve seen this play out across food and beverage for years, recently have seen it blow up in supplements, and now it’s officially crossed into medicine. Same function, cooler vibes, higher price point, fewer chemical-sounding ingredients or colors. Genexa has been one of the clearest signals that consumers are seeking out this shift.

Protein snacks for all. simplyFUEL, a protein snack brand founded by sports dietitian Mitzi Dulan, partnered with Humble Growth, a growth equity firm. Humble Growth acquired a minority stake to help scale the brand, which is distributed nationwide at major retailers including Costco, Sam’s Club, Walmart, and Target.

For the sake of the children! FoodNerd, a company making nutrient-dense toddler snacks, raised $7.5M in a Series Seed round led by Selva Ventures to expand its nutritious, shelf-stable products for kids into 800 U.S. stores. The funding supports its new 28,000-square-foot facility, nationwide retail expansion, and direct-to-consumer launch

This fits into a growing wave of premium kids’ nutrition brands bringing better ingredients and functional benefits to the category—from Cadootz’s seed oil-free cheese crackers with 5g protein, to Jubilee’s protein milk flavored with fruits and veggies, to Little Spoon’s organic baby food and toddler meals or Yumi’s fresh, chef-crafted baby food delivery service. As parents seek cleaner alternatives for themselves they’re also seeking cleaner alternatives to legacy brands for their kids.

Weekly Pickups

Check out our recent episode of The Curious Consumer! We talk about Koia's new drink that has every trend in one can, why all brands land at Target, and more!

If you haven’t yet, please subscribe, like, leave a comment, and share it! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.

Great issue for a snow day! HR Thanks! Stay warm. 💙🥶